eligibility criteria of property loan

A loan against property is a secured credit form that has become extremely popular among borrowers. This is primarily a multi-purpose loan that individuals can avail from different financial institutions by pledging their existing property as collateral.

Based on the property’s market value, one can acquire approximately 40%-70% of the loan amount. One can pledge both residential and commercial properties as collateral, but one must produce necessary documents to avail the preferred loan amount. Thus, if individuals are willing to apply for a loan against property, they should be mindful of the following factors.

Considering factors while applying for a LAP

There are different types of loan against property based on the property type, applicant’s employment and fund usage. Individuals can meet their high-ticket personal and professional financial requirements with the fund. As already mentioned, individuals can avail a sizeable amount depending on the property’s market value, eligibility, and documentation.

Let’s take a look at the factors that one can consider when they apply for loan against property:

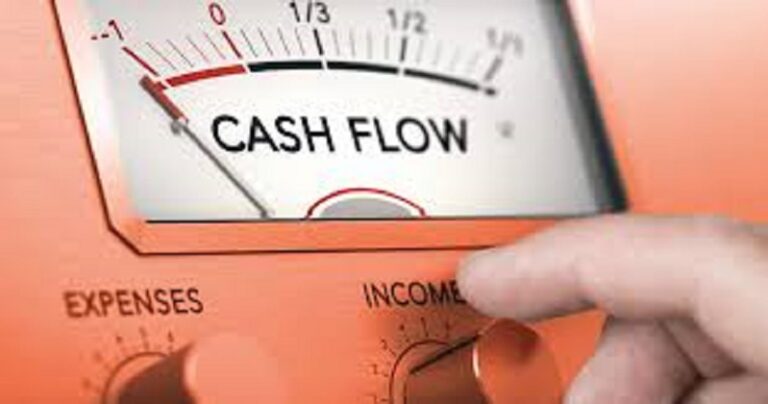

- Applicable interest rate

Interest rates on loans against property will depend on various factors that involve income, credit history, loan amount, repayment tenor etc. It can also differ from one lending institution to another. When individuals opt for a long against property, they must ensure availing the most affordable one.

For this, one needs to do thorough research and explore different financial institutions available in the market offering competitive loan against property interest rate. A little difference in interest rates can significantly impact one’s repayment capability in the long run.

- Evaluate eligibility and documentation

The eligibility criteria of property loan depends on various factors, including present financial obligations, income, and property value depending on market rates, age, etc. One can apply with any of their family members as a co-applicant for the loan even if they are not the co-owner of the property. This will further help in enhancing the loan eligibility of an applicant. Following are the eligibility criteria for loan against property for both salaried and self-employed individuals:

Salaried

- Applicant’s age should be within 28-58 years

- Should be a salaried employee in a reputed private or public organisation

Self-employed

- An applicant’s age should be within 25-70 years

- Must be a self-employed individual with a stable income from the business

Besides, individuals need to produce the following documents to ensure a hassle-free application procedure:

- ID and address proof

- Present salary slip, financial statement of previous 3 months, IT returns (salaried)

- Mortgaged property documents

- PAN card/ Form 16

- Financial statement of last 6 months, income document etc. (self-employed)

- Select suitable tenor

Usually, borrowers are comfortable with extended tenor, which further increases the interest cost. Therefore, before settling down for a specific lender, one should understand the exact borrowing cost. In such cases, one can take the help of a property loan EMI calculator to determine the overall borrowing cost that involves EMI, interest component and other associated charges.

One must make an informed choice between floating and fixed interest rates and keep a check on market fluctuations.

- Processing and other associated charges

One of the essential costs that borrowers forget to consider when they apply for a loan against property is the loan cost, processing fees and other related charges. Some financial lenders impose prepayment charges, service charges, statutory charges etc. Hence, the borrowers need to evaluate these charges and estimate overall cost of the loan. Such charges can bring a significant change in the overall borrowing cost and a borrower’s repayment plan.

Apart from knowing all these factors, eligible borrowers can also avail pre-approved offers extended by reputed financial lenders. These exclusive offers simplify and accelerate the loaning procedure, which further helps borrowers in saving more time. Therefore, debtors can check their pre-approved offers by mentioning their names and contact information.

Hence, to sum up, individuals need to consider these aforementioned factors before they apply for a loan against property to ensure a hassle-free repayment procedure. With multiple advantages, this financing option has become a popular and convenient borrowing solution for individuals.